Last week it seemed nearly all public attention was focused on the Helsinki Meeting, especially the press conference with Presidents Trump and Putin. Of course, the talking heads had a field day dissecting what we knew about the meeting, speculating on the private discussions, and examining what Trump said, then later explaining what he meant to say.

If, however, you are keenly attuned to US and global energy matters and set aside the political theatrics, media games, and fascination with American and Russian intrigue, you may have noticed something very interesting that happened at Helsinki that inadvertently links to a process taking place this week at the Federal Energy Regulatory Commission (“FERC”).

The very first question asked during the press conference was not about nuclear arms, Russian annexation of Crimea, the Ukraine, Syria, Iran, North Korea, or Russian intervention in US elections. It was about natural gas.

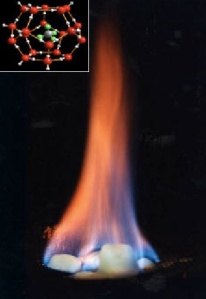

Specifically, a Russian journalist pointedly asked President Trump how he squares his position that the Nord Stream II pipeline makes Europe a hostage to Russian natural gas and alternatively, the US is a safer, more reliable supplier. Yet, at the same time, the US relies on Russian gas (delivered as LNG) to supply Boston. In essence, asking President Trump whether the US is truly capable of reliably suppling Europe with American gas.

So, what does that have to do with FERC?

FERC is the independent federal agency that, under the Natural Gas Act of 1938, has jurisdiction over siting, construction, and operation of any natural gas facility that transports gas in interstate commerce. This includes natural gas pipelines, storage facilities, and LNG terminals.

Before any new interstate natural gas facility can be built and operated, the company must receive a Certificate of Public Convenience and Necessity from FERC. It often takes more than two years before FERC can decide whether to issue a certificate.

The review process, dictated by the decades-old National Environmental Protection Act (“NEPA”), is a complex and detailed assessment involving multiple federal and state agencies. Under the NEPA process, FERC directs the overall review. Before deciding to grant an applicant with a certificate, FERC weighs the project’s benefits against possible adverse impacts.

While the White House Council on Environmental Quality has proposed making the NEPA process more efficient, well-funded opposition groups have raised questions in federal courts about, among other things, the level of FERC’s consideration of greenhouse gas emissions.

The bottom line is that having failed to stop America’s upstream oil and gas resource development with their “keep it in the ground” campaign, anti-fossil energy activists are pouring money and resources into federal court appeals of FERC’s certificate decisions.

The natural gas infrastructure itself has been proven to be safe, efficient, and of limited concern regarding GHG emissions. Ultimately, the appeals simply frustrate the process, extend permitting schedules, and foist millions of dollars of additional costs upon the project developers and American energy consumers.

The good news is that FERC has already recognized the challenge of reviewing and approving new natural gas infrastructure and set into motion a process to collect comments and suggestions on actions needed to avoid bottlenecks forming that would block US natural gas production from reaching American and global energy consumers.

Last year, shortly after the quorum of FERC commissioners was re-established, the Chairman stated his desire to revisit the way in which FERC assesses new gas facility certificate applications. On April 19, 2018, FERC issued a Notice of Inquiry (“NOI”) to initiate a review of its 1999 Policy Statement regarding the analytical and procedural processes currently undertaken to determine whether a proposed project should be certificated.

The NOI noted that significant changes have taken place in the natural gas industry over the 19 years since the 1999 Policy Statement was adopted. Most significantly, hydraulic fracturing has ushered in a “revolution in natural gas production” leading to major geographic shifts in the location of new natural gas supplies, changes to gas flows in the interstate pipeline system, and expanded use of natural gas for power generation and as a feedstock for the domestic petrochemical industry.

Comments regarding the NOI from the natural gas pipeline industry and other stakeholders are to be filed with FERC this Wednesday, July 25th.

Those supporting new gas infrastructure can be expected to voice opinions about such things as the efficiency and effectiveness of the NEPA review process, coordination of federal and state reviews, post certificate appeals, and policy consistency regarding GHG standards and demonstration of market need. Ultimately, process timing and certainty will be key.

Those opposed to pipelines will likely target contractual standards for new projects, seek regional planning for natural gas, express concerns about overbuilding pipeline capacity, and support landowner rights and the elimination of eminent domain. The opposition has long argued that FERC favors the fossil fuel industry and “rubber stamps” pipeline company applications.

The NOI will be an important source of input to FERC as it reviews its certificate policy. How extensively its policies and procedures change remain to be seen. But the review is warranted.

More importantly, however, if we don’t soon get the much-needed new natural gas infrastructure permitted, built, and operating, we won’t be able to take advantage of our energy resources. Then the question posed by the Russian journalist in Helsinki may, in fact, prove prescient.